Helium Investing and BREXIT Influenced Volatility in the Stock Market

While the world has to wait to learn the long term impact of England’s BREXIT vote to leave the European Union, one thing that is for sure is the devastating short term impact and volatility in the Stock Market of that decision. “The outcome sent global markets into a tailspin.” There might be several years of instability as a result of this major shift in global finances. In the meantime, expect a bumpy ride in the stock market.

Smart investors are looking to smooth out that ride and BREXIT proofing their investments by protecting their capital and diversifying their portfolio with safe havens such as Helium, Gold and other natural resources, the perfect option for those who want to

buy fractional shares

Clearly, now is the time to consider diversification in safe haven investments like direct participation in Helium exploration and production. A direct investments in Helium production and exploration is not susceptible to the risk of big drops in the market because Helium’s demand is high, supply is limited and prices are fixed by contracts.

A safe haven is an investment that is expected to keep its value or even increase its value in times of stock market volatility. The goal of a safe haven is to limit an investor’s exposure to losses in the event of market downturns.

Stock Market Volatility

Following the announcement of the BREXIT vote, the Dow Jones plummeted 610 points (it’s 8th biggest drop), or about 3.4%, on Friday, June 24. Likewise global stock, currency and other markets had a severe adverse reaction in response to Britain’s surprising vote to leave the European Union.

“Many investors are worried about the next big one, the next major global recession and 50% decline in the market like we saw in ‘08 and ‘09, and I don’t think this is it,” said Jeff Kleintop, chief global investment strategist at Charles Schwab. “I think this is more akin to some of the shocks we’ve seen over the past five years.” While BREXIT may not be the impending “Big One” it’s an example of how the unstable global economy is creating volatility in the Stock Market and supports why smart investors are looking to protect and diversify their portfolios in safe havens.

Helium is a Smart Investor’s Safe Haven

Helium is essential in the supply chain of medical, technology, military, space exploration industries and demand for Helium is at an all-time high.

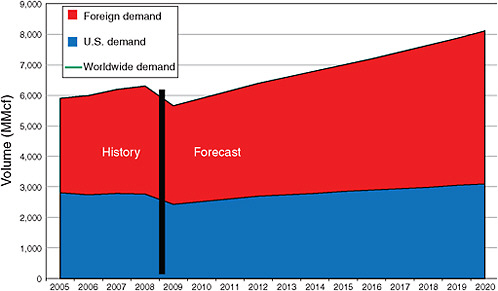

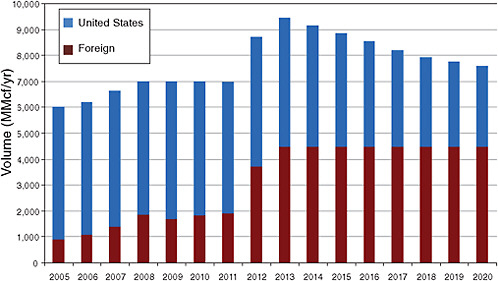

While demand is high and is projected to grow, Helium is a limited resource with supply dropping.

This supply and demand relationship coupled with Helium prices locked in by contracts means the potential for significant returns for qualified investors.

An additional benefit of investing in Helium are the tax deductions for accredited investors with direct participation in Helium exploration and production.

How to Directly Invest in Helium Exploration and Production

With volatility on the rise, uncertainty domestically and overseas and concerns around the presidential elections in the US, now is the time to consider diversification in stable “safe haven” investments like direct participation in Helium exploration and production.

Accredited investors may qualify to invest in independent Helium exploration and production projects. To learn more contact Summit Source Funding LLC at (800) 928-6994.